Dear client,

As 2023 draws to a close, we confirm, once again, the importance of adhering to a sustained, long-term investment style and not giving way to emotions, which were plentiful in a year wherein the antics of the market compounded anxiety and confusion.

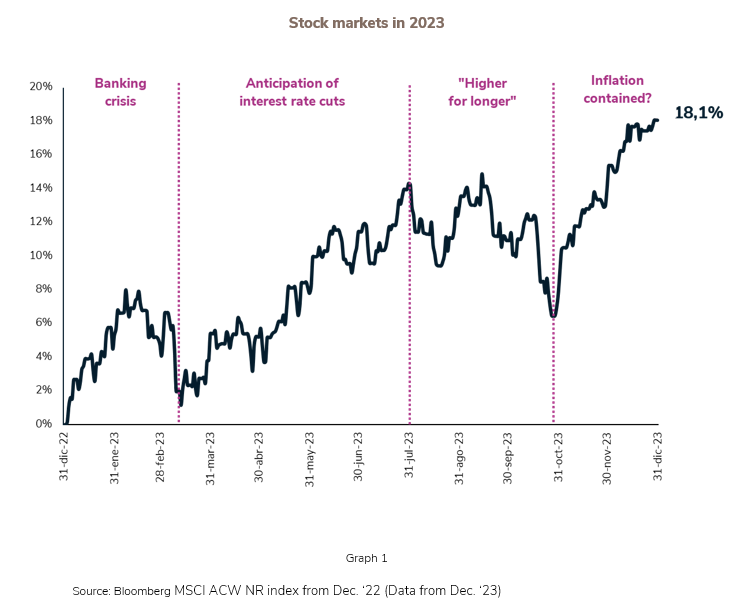

The profile of stock indices in 2023, illustrated in Graph 1, were defined by four distinct phases, all related to changing perceptions of global economic prospects and, above all, the monetary policies of the year’s leading players, the central banks.

Three possible errors in 2023

This precarious evolution set traps to avoid.

In the past year, investors may have committed to three potential errors:

1. Withdrawing from the market: not investing

After a disastrous 2022 for both bonds and equities, and amid pessimistic forecasts about an imminent recession, many investors and countless investment strategists opted to maintain a cash position.

This was an unfortunate decision, resulting in a loss of purchasing power and a failure to participate in the dazzling recovery of both bonds and equities after October lows. And, therefore, failing to recover from last year’s diminished valuations.

2. Not capitalising on interest rate peaks

In 2022 and 2023, the central banks applied a restrictive monetary policy with few precedents. It triggered considerable valuation declines.

But, when Q4’23 data suggested inflation had been contained, the markets celebrated with spectacular increases (see our November Opinion Flash), taking into consideration—perhaps overly optimistically—looming US interest rate cuts in March 2024.

3. Taking the continued relief rally as a given

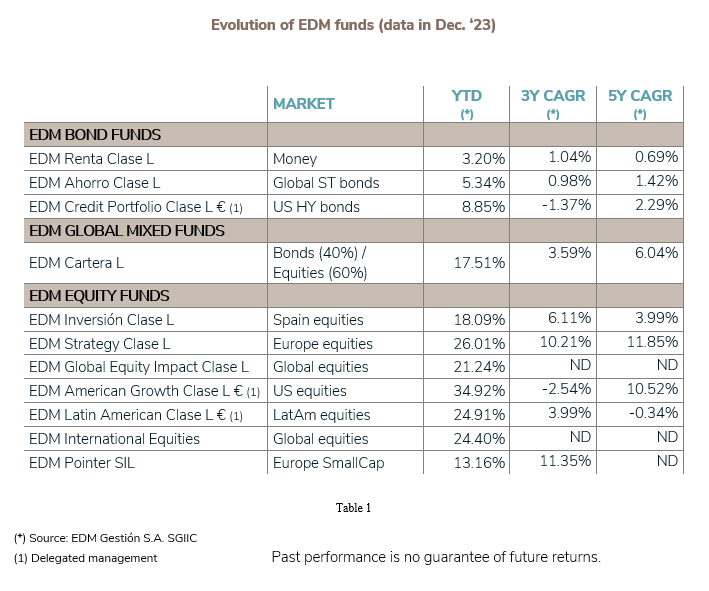

As Table 1 shows, the results from 2023 helped funds recover from 2022 declines and restore 3Y and 5Y annualised results: great news!

But November’s vertical growth only demonstrated how pessimistic investors were at the Q3’23 close.

Linear continuity of this rhythm in 2024 is unlikely, once valuations normalise.

What indices don’t say

The progress of passive management obscures a special phenomenon. Rising indices are attributable predominantly to a small group of companies, without which the same indices would appreciate only marginally.

The so-called 'magnificent seven' are a group of US tech companies whose stock market performance accounts for 36% of the S&P 500’s gains since 2015. This trend reminds many of the dot-com bubble of 2000 or the Nifty Fifty of the 1970s.

In Europe, a small pool of companies dubbed the 'magic eight' account for 50% of Eurostoxx50 gains since 2015.

In this respect, it seems relevant to share the following points:

1. The importance of stock picking. EDM’s global equity portfolios include eight of the fifteen US and European companies mentioned.

2. Unlike previous periods, the current stars are companies of extraordinary quality from a management perspective with very strong balance sheets.

3. The profiles of the eight European companies and the seven US counterparts are completely different, with the former peppered across various sectors with more contained earnings multipliers (P/E ratio).

4. Given the difficulty of formulating judgements about the future profit growth (EPS) of tech companies, it is prudent to continually monitor this data to confirm current valuations.

Bonds: the star of the year

After a devastating 2022, with negative returns of -7.2% for the index (1-5Y Euro Government), bonds had a mixed year: negative in the first half of 2023 and splendid in the second.

In any case, after 14 years of minimal or negative returns, they once again have a place in diversified portfolios, either to generate income and/or reduce long-term volatility.

With the exception of high-yield bonds, the real historical yield (deducting inflation) of fixed income barely reaches 1%. Now that inflation appears to be heading toward the 2% target, it is surprising that 10Y US bonds continue to offer 4%-5%, with the German equivalent at 2%-3%.

2024 and beyond: the years ahead

At our Investment Forums in Barcelona and Madrid, we emphasised our interpretation of the structural factors that have changed the world of economics, politics, and subsequently, investment. This shift, trumpeted some time ago, materialised in 2022/2023 and will extend into the future.

Essentially, we believe certain basic elements will define the decade to come:

• The stabilisation or reversal of the globalised economy

• Ongoing demand for financial resources to support the climate transition, defence spending, and debt refinancing

• Political framework oriented toward populist positions and autocratic public management

• Economic interventionism and probable tax increases.

For these reasons, we suspect that the cyclical decline in interest rates on bond yields cannot obscure the fact that inflation expectations do not fall below 3%-4%.

Significantly, last July EDM’s Asset Allocation Committee agreed to diversify the portfolios under discretionary management and advisory regimes, increasing the weight of bonds. This policy is consistent with an emphasis on quality shares, which has always been the focus of EDM’s equity portfolios that, year after year, offer returns well above inflation.

The enormous uncertainty about economic developments and central bank monetary policies underlies our approach to asset allocation in 2024 and beyond. However, one thing remains the same: quality shares constitute the core of the portfolios managed by EDM.

We therefore enter the new year with the satisfaction of having largely recovered the valuation declines of 2022 and maintaining our characteristic 'sceptical optimism'.

Many thanks for your continued trust and we wish you a very happy 2024.

María Díaz-Morera

Chairperson

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them to comply with the terms and conditions of the offer in question.

2) EDM Gestión, S.A.U. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

. Market fluctuations due to unforeseen circumstances.

. Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MiFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity, and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) To obtain the mandatory legal information, please visit the website of the management company, EDM Gestión, S.A.U. SGIIC, at www.edm.es. You may also obtain a hard copy of this information upon request, free of charge.

9) Nothing in this document constitutes investment advice, nor does it include any representation about the suitability or appropriateness of any investment or strategy for your particular circumstances, and no personalized recommendation can be derived therefrom. Under no circumstances will decisions based on this information and possible legal, financial, fiscal or other consequences imply any liability for EDM Gestión.