The economy: Inflation eases…

-

October data confirms inflation is easing in both the US and the European Union: welcome news.

-

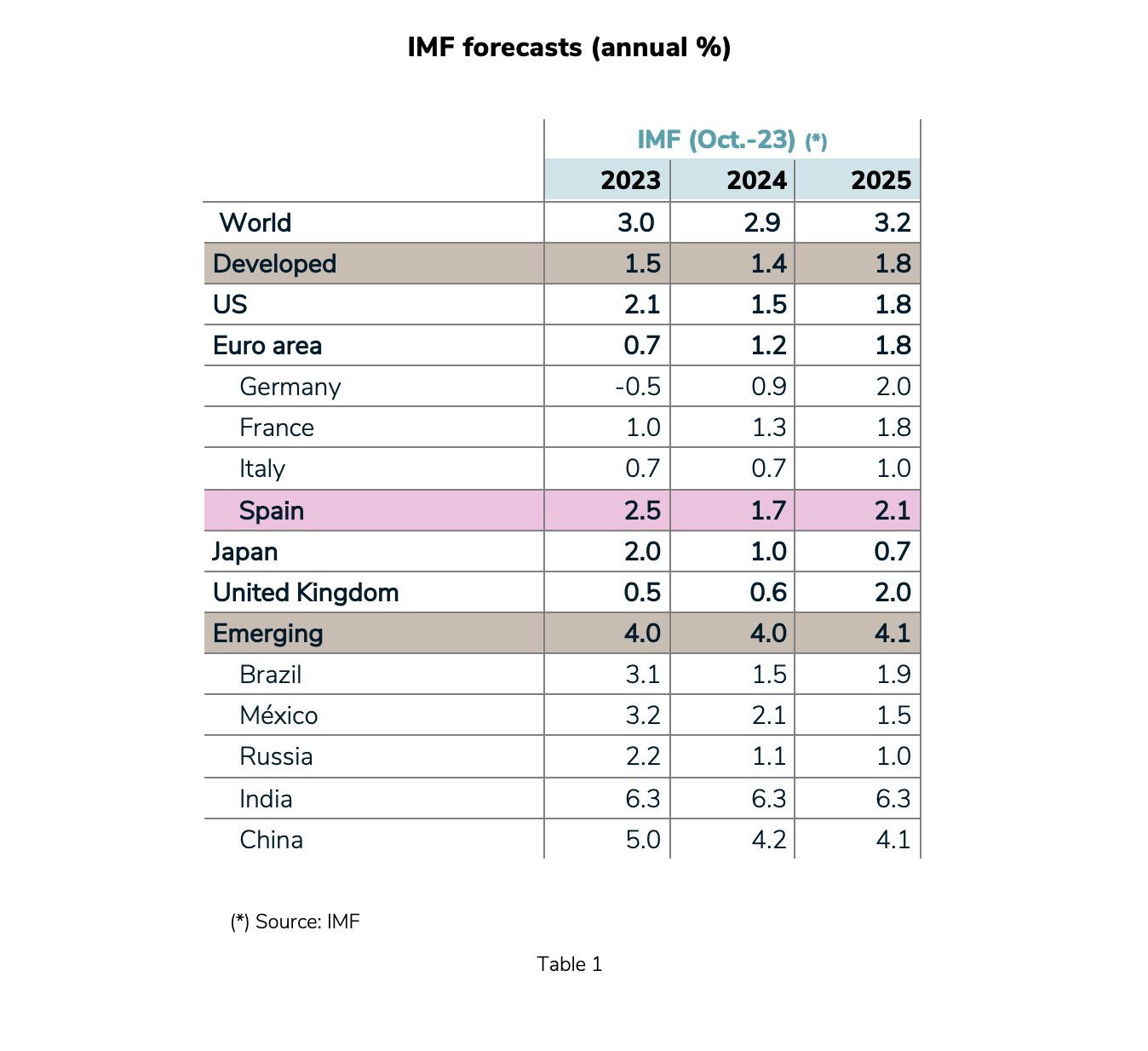

The robust US economy maintains its high growth rate, while in Europe, the Germany recession curtails economic activity (see Table 1).

- Regardless, 2024 will see moderate growth in a ‘slowdown’ scenario. Debate persists, however, as some observers predict a mild recession in the second half of the year.

- Fortunately, geopolitical tensions (Middle East, Ukraine) have not caused oil prices to spike, as we have seen in previous conflicts (1973).

Markets: … triggering market euphoria

-

Positive inflation data suggests an end to interest-rate hikes. Cuts, however, are another matter.

-

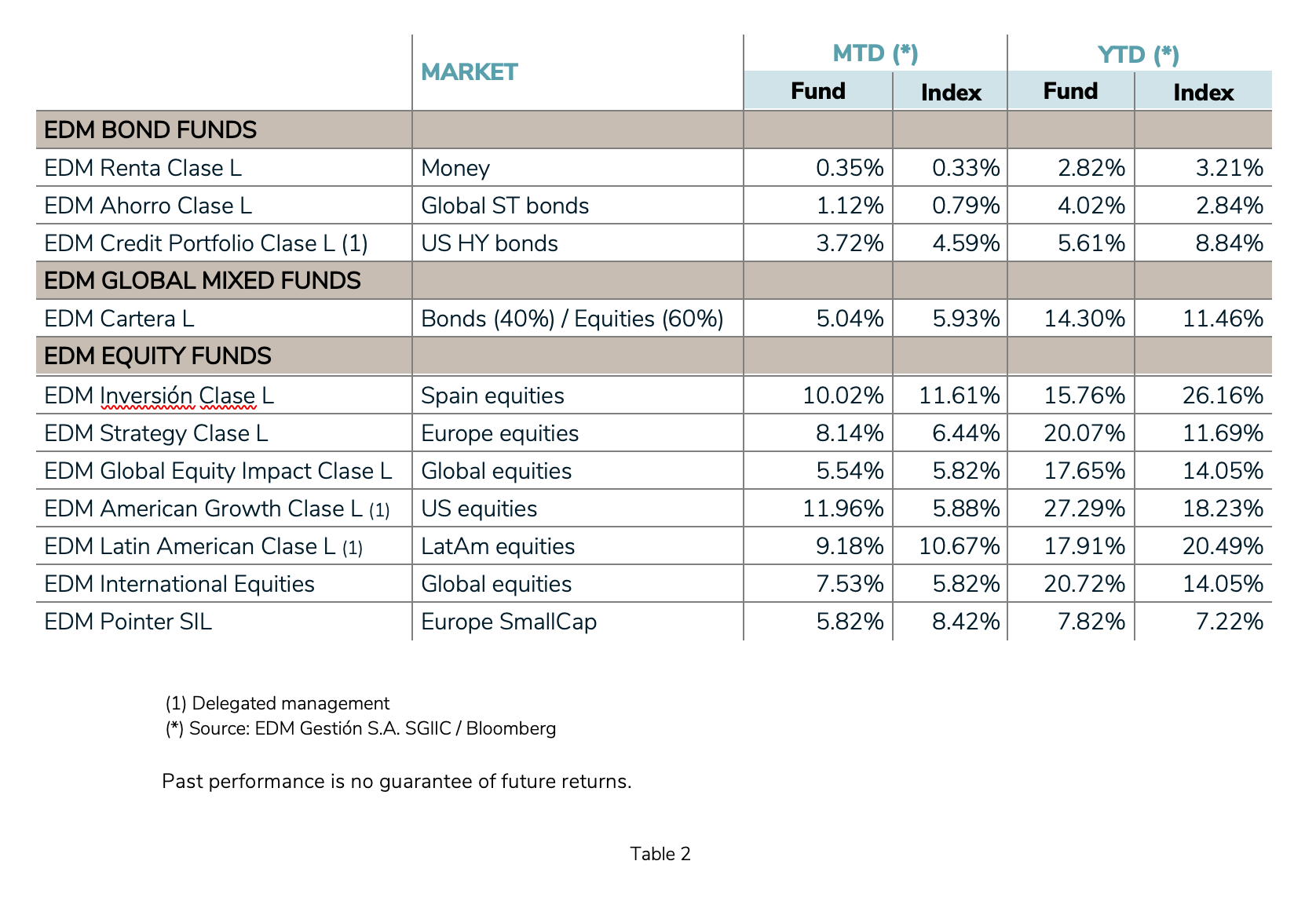

This perspective prompted a phenomenal rally on the debt market (rising prices, falling yields), as well as for stock indices and EDM fund valuations (see Table 2).

- It is worth noting that index increases are highly concentrated around a few quality growth securities: in the US, these have a tech profile (‘Magnificent Seven’), while they are more diversified in Europe (‘Magic Eight’).

- Credit markets (IG and HY bonds) show no symptoms of quality degradation, though defaults and non-payments are beginning to appear in some segments.

- High interest rates have led to an unprecedented shift away from unremunerated bank deposits toward Treasury notes/bonds.

Investment policy: Diversification and caution

- After two or three months of unease about monetary policy, November’s euphoria was more a relief than a sign of an expansionary phase in the world economy.

- This will not prevent the companies in which EDM invests from registering reasonable earnings-per-share growth in 2024, in accordance with their structural growth profiles. This is the firmest foundation for the coming months.

- Less predictable is the moment when monetary policy will relax. When it does, valuations (P/E ratios) will contribute favourably to results.

- We maintain our approach of capitalising on attractive interest rates (4%-5%) and parking available money to make the most of opportunities that, in the current global political context, we believe are likely to materialise (‘known unknowns’).

- Finally, we consider it reasonable to extend the duration of bond portfolios.

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them to comply with the terms and conditions of the offer in question.

- EDM Gestión, S.A.U. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

. Market fluctuations due to unforeseen circumstances.

. Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MiFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity, and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) To obtain the mandatory legal information, please visit the website of the management company, EDM Gestión, S.A.U. SGIIC, at www.edm.es. You may also obtain a hard copy of this information upon request, free of charge.

9) Nothing in this document constitutes investment advice, nor does it include any representation about the suitability or appropriateness of any investment or strategy for your particular circumstances, and no personalized recommendation can be derived therefrom. Under no circumstances will decisions based on this information and possible legal, financial, fiscal or other consequences imply any liability for EDM Gestión.