The economy: central banks get serious

-

Inflation data on both sides of the Atlantic eases slightly (a turning point?) on declining oil prices (noticeable at pumps).

-

This data fuels two opposing theories: the optimists claim the beginning of lower inflation rates, while the pessimists, focusing on still-high underlying rates, maintain that it will persist.

-

If a recession (which has myriad definitions) ultimately materialises, it will be the most anticipated in history, and while its materialisation is possible, it is by no means guaranteed.

-

Since the Jackson Hole Symposium, the central banks have tried to evade the prevailing sense that their monetary policies might trigger a recession.

-

In the US, the most apparent symptom is the slowdown in the real estate sector, as the cost of mortgages begins to impact demand, the result of the Fed’s strict monetary policy.

-

At the moment, demand remains healthy, despite the loss of purchasing power. In Europe, though the situation is deteriorating in Germany, the tourist countries in the south (Spain, France, Italy, Greece) are experiencing an incomparable summer.

-

Still, consumer confidence in the current environment is fragile, causing many to question its longevity.

-

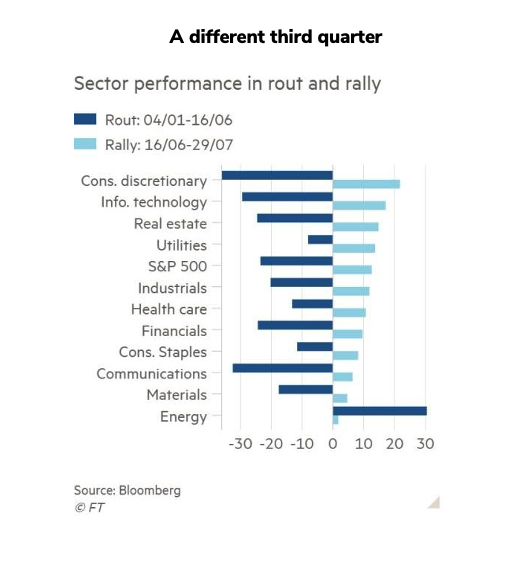

To index volatility we must add sector rotation. The graph below illustrates the radical turnaround between H1’22 and this summer. In the last week of August, the situation changed again.

-

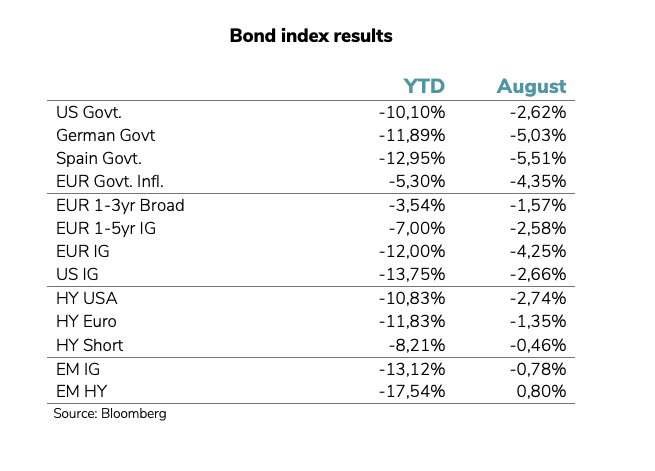

Bonds also somersaulted in late August. All fixed-income segments continue to post losses since 1 January, especially among maturities greater than five years. Particularly striking is the evolution of public debt.

Investment policy: Macro vs. Micro

-

Elevated volatility and uncertainty make macroeconomic forecasting difficult, once again lending credence to our investment style, which focuses on asset selection. Anticipating economic cycles and stock market performance is always an elusive and risky practice.

-

Still, the Q2’22 earnings season delivered no negative surprises. By contrast, the results were positive among our strict selection of global companies that populate the portfolios whose management is entrusted to us.

-

Fortunately, these results confirm the message of confidence we conveyed to our clients throughout a disastrous Q1’22. Despite August declines, performance over the summer has minimised the H1’22 downturn.

-

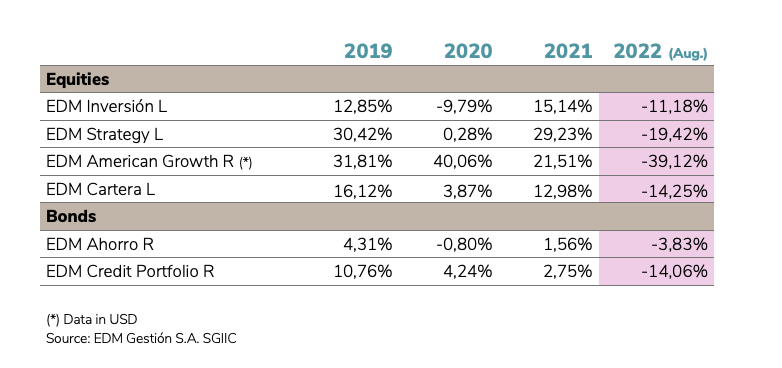

The results of our long-term management are based on profit growth rather than the expansion of multiples (P/E ratios), which we do not expect in the coming years. The table below illustrates the results of investing in our funds in the last three years. They outperform inflation by far.

-

The table also includes bonds. At current prices, they offer a yield that, though lower than inflation, is positive for the first time in several months: good news for the most conservative investors.

-

Though no one knows what will happen with regard to markets or the economy in the immediate future, there is a general sense that the central banks will not lead economies into a deep recession. Rather, to preserve their credibility, they insist on perpetuating an anti-inflationary message: it’s a game of cat and mouse.

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient.

The information may refer to or entail additional, separate documentation, which you may request from EDM.

If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

2) EDM Gestión, S.A.U. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) You can obtain the documentation of mandatory legal information on the website of the Management Company (EDM Gestión SA SGIIC), www.edm.es a paper copy of such information shall be made available to you free of charge upon request.