THE ECONOMY: a SLOWING BUT PERSISTENT RECOVERY

- Growth in Q2 2021 was adversely affected by the unforeseen impact of:

- Spikes in the COVID-19 Delta Plus variant

- Skyrocketing energy costs

- Supply problems

- This led forecasters (including the IMF) to shift a portion of growth to 2022. In the US, the slowdown was particularly intense in Q3 2021, with EU growth outpacing that of the US.

- In China, sluggish growth is the result of political decision-making that aims to secure more inclusive development and reduce real estate investments of questionable profitability.

- Most delays are the result of supply shortages in the industrial sector.

- Inflation, present in the press and in markets, may peak in Q4 2021.

- US and Eurozone central banks begin tapering bond purchases, but are cautious about raising interest rates. In other counties, monetary authorities have already raised rates.

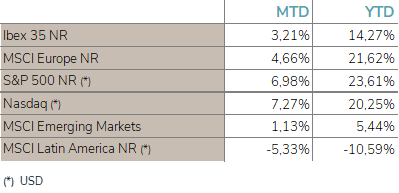

MARKETS: A GOOD MONTH FOR EQUITIES

- After a dismal September, stock market indices regained ground in October.

- October volatility is a reflection of recent rotations in:

- Value vs. growth

- Cyclical vs. defensive

- Big cap vs. small cap

- Anxiety among tactical investors is understandable, particularly after cumulative YTD gains.

- Emerging markets, especially China, diverge sharply from those of the US and Europe. How long will they stay undervalued?

- By contrast, investments in sovereign debt, primarily those with prolonged maturities, perform negatively as the growth of adverse pricing far exceeds coupon amounts. Bond investors, meanwhile, try to anticipate a potential tightening in the changing pace of monetary policy.

INVESTMENT POLICY: INFLATION TODAY? YES. AND TOMORROW

- As we enter the earnings season, we can confirm that the portfolio companies that have already released their results have performed in line with or better than expected.

- In the long term, the EPS ∆ is the main driver of valuations, but in the short term it conflicts with concerns about a sharp rise in inflation and the impact on discount rates.

- The long-term evolution of inflation is unclear. Though a degree of risk exists, it is far from a sure thing.

- Another factor is the socio-political dynamic that could precipitate changes in the trends that have prevailed for decades, for example, globalisation.

- In the current climate of uncertainty and unpredictability, we focus our efforts on picking companies with the ability to set prices for their products and services, as the best protection against an inflationary environment.

- We anticipate a volatile market as we approach year-end, but our profit growth estimates for 2022 exceed those of the market as a whole, which is reassuring.

- We continue to shy away from public debt and concentrate on short-term fixed income and private bonds. The results obtained by EDM Ahorro and EDM Credit Portfolio confirm the effectiveness of this strategy.

LEGAL CONSIDERATIONS

- This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

- EDM Gestión, S.A.U. SGIIC is a Spanish limited liability company registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification number A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

- Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

- The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

- This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

- This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

- To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.