THE ECONOMY: ECONOMIC RECOVERY UNDERWAY

- Economic recovery accelerates as the service sector joins an industrial sector already in full expansion.

- Surging demand has caught many companies off-guard with minimal inventories. These companies are now in a frenzy to secure the supplies needed to meet an unexpectedly vigorous demand.

- Robust demand and limited supply have caused bottlenecks in raw materials, components, and even freight. This congestion, in turn, has triggered the price hikes we are seeing.

- In April, the inflation registered in the US served as a wake-up call, shedding light on inflation risk and a possible response from the central banks. . The US Congress is currently debating two additional fiscal stimulus programmes, the figures of which are colossal.

- Fortunately, widespread vaccinations herald an imminent recovery in Q2 2021 for certain countries, including Spain, that are highly dependent on mobility. The OECD recently revised its growth estimate for Spain upward in light of a rebound across the EU.

MARKETS: PORTFOLIO ADJUSTMENTS

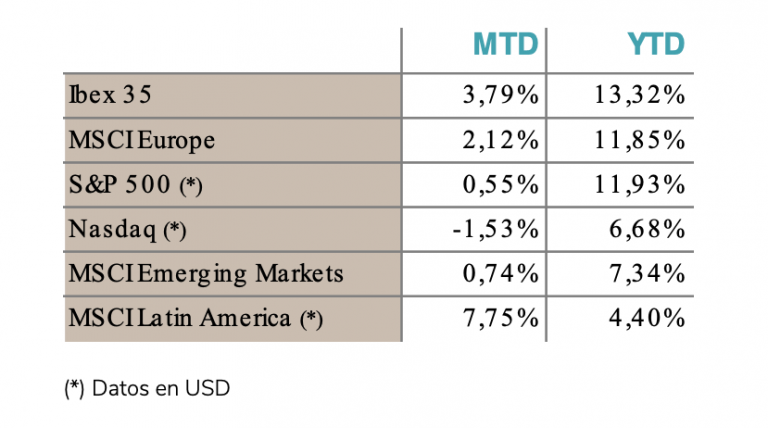

- Against a favourable economic backdrop, stock markets had a positive month in May despite increasing volatility prompted by the inflation surprise.

- The table below indicates the stock market performances both for the month and for the year thus far, giving credence to those who believed the current crisis would be brief but intense.

- Global indices, however, conceal major differences among geographical regions and particularly among company profiles. As such, cyclical/value companies gain the favour of investors (MSCI Value +14.72% YTD) to a greater degree than growth companies (MSCI Growth +6.02% YTD).

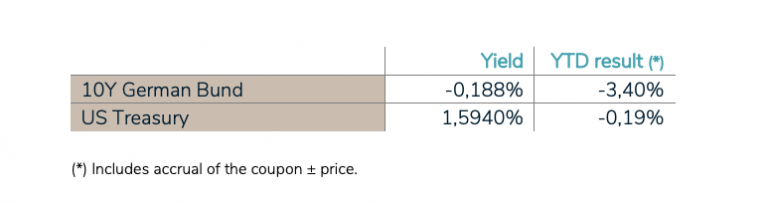

- Concerns about the possible re-emergence of inflation after decades of virtual nonexistence have continued to drive up debt yields owing to falling prices, as investors aim to protect themselves from inflation risk with increased profitability.

- Corporate bonds (private fixed income) with ratings of lower quality than public debt (BB/B) weather this environment more effectively and are in positive territory. There is no indication that the trend will shift in the short term.

- The USD, affected by the public deficit and the latest inflation figures, continues to recede against the euro

INVESTMENT POLICY: ANXIETY AND ALTITUDE SICKNESS

- The impact of inflation on interest rates and its subsequent influence on valuations are the markets’ primary concern.

- Investors hesitate in adopting the most appropriate structure for their portfolios in light of the possible return of inflation, the profile of which is uncertain: no one knows if it is transitory, as the central banks assert, or structural.

- After 30 years during which bonds and equities have performed hand in hand, both delivering positive results, they may return to their traditional negative correlation, which causes concern among many investors.

- In the coming quarters, we may see a compression of multiples (p/e ratio) among companies with highly visible long-term growth as their earnings per share (EPS) increase more than their share prices. This would cheapen our portfolios but should not alarm those who invest in the long term based on fundamental data.

- So much anxiety seems to have eclipsed the reported Q1 earnings, which wildly exceeded forecasts and our own expectations, reaffirming our selection.

- Our preference for shares in top quality, geographically diversified companies allows us to approach this new phase with confidence. In the long term, investing in quality companies will constitute a steadfast stronghold if inflation gains traction. We continue to favour this segment.

LEGAL CONSIDERATIONS

- This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

- EDM Gestión, S.A.U. SGIIC is a Spanish limited liability company registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification number A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

- Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

- The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

- This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

- This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

- To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.