The economy: An uneven global slowdown

-

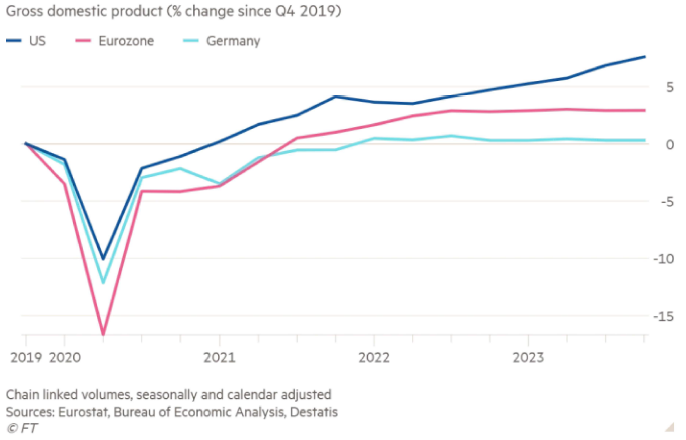

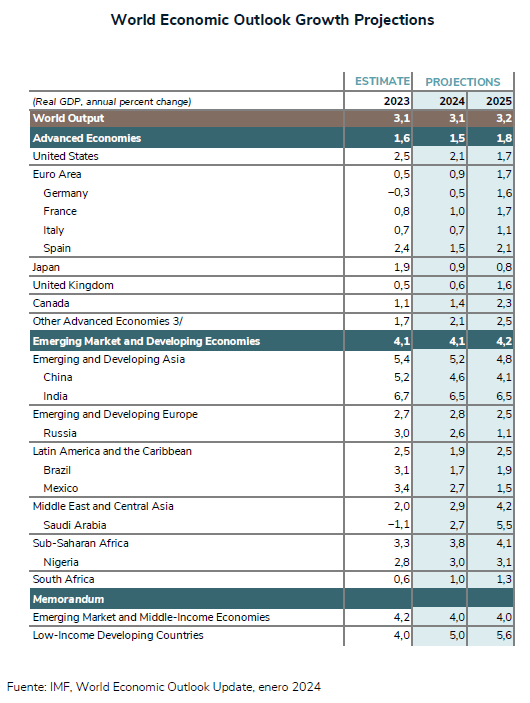

As 2024 begins, we see divergent growth trends in the major economic areas: the US retains its strength due to the muscle of the technology sector, weak growth persists in the EU, and China fails to dispel misgivings about its recovery.

-

Favourable inflation data in both the US and the EU in the last three months has led “Mr. Market” to conclude that inflation is now under control. This is reflected in the price of most assets, taking into consideration the prospect of a soft landing.

-

Germany leads Europe’s sluggish growth (amid a technical recession), as does the industrial sector, while services maintain anaemic growth in the economy overall. The Spanish economy, meanwhile, is outpacing the European average in terms of growth. The European economy is affected, in part, by weakness in China, whose recovery still has investors apprehensive (see Appendix).

-

The slowdown (soft landing) is the result of contractionary monetary policies (interest rates), as opposed to expansionary fiscal policies (public spending).

Germany’s post-pandemic economic recovery has faltered

Markets: Waiting on the central banks

-

The good macro data at year-end prompted continued optimism on the markets, which posted sharp gains on the prospect of rate cuts in 2024, cuts whose schedule is yet to be confirmed.

-

Initial earnings reports for 2023 indicate persistent growth, albeit with sizeable disparities by sector and company.

-

For this reason, any delay on the part of the central banks in cutting rates that the market has already taken into account would result in price corrections for both shares and debt securities.

-

Thus, US Treasury bond yields rebounded this month from December lows. Rising yields mean falling prices.

-

Regardless, official interest rates are above registered inflation. In other words, monetary policy remains contractionary at the moment.

Investment policy: Caution in valuations

- Many observers believe that the rapid recovery of share prices in 2023—which, in the case of several EDM portfolios meant recovering 2022 valuation losses—partially anticipate the advances expected in 2024.

- This scenario prompts the reorganisation of portfolios with greater concentration on bonds, which continue to attract the majority of investment flows.

- The caution recommended does not stem so much from excessive valuations, should the expected 2024 profit growth materialise, but from the many unpredictable, global, geopolitical risks we face.

- It should be noted that the expectation to maintain yields for long-term bonds (5+ years) is removed from the consensus of interest-rate cuts in the short term. The enormous demand for public treasuries to refinance debt contracted at low rates during Covid is not unrelated to this fact.

- Therefore, in this moment of waiting on the central banks, the safest, most ascertainable approach is the selection of quality assets. This includes companies with businesses that have minimal cyclical dependence and little or no debt.

- With regard to bonds, the diversification of maturity dates is advisable. It is premature to dive entirely into credit risk (HY) without assurance that the risk of a recession is definitely behind us.

Appendix

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them to comply with the terms and conditions of the offer in question.

2) EDM Gestión, S.A. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

. Market fluctuations due to unforeseen circumstances.

. Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MiFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity, and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) To obtain the mandatory legal information, please visit the website of the management company, EDM Gestión SA SGIIC, at www.edm.es. You may also obtain a hard copy of this information upon request, free of charge.

9) All the opinions and estimates provided are based on sources considered reliable. Nevertheless, EDM Gestión, SA, SGIIC cannot guarantee their accuracy or integrity, and does not assume liability for any direct or indirect loss that may result from the use of the information provided in this document.

10) The content of this document is intended for informational and advertising purposes only. It is not and cannot be considered investment advice or legal opinion, nor is it intended to substitute the necessary counsel in this regard or constitute an offer to sell or buy. EDM Gestión, SA, SGIIC advises that past returns are not a reliable indicator of future profitability.