Dear client,

After 12 months of the pandemic, the financial asset portfolios managed by EDM have far exceeded the valuations of one year ago. Decisive support from public bodies (governments and central banks), coupled with a progressive vaccine rollout, provide the backing necessary to reach the brink of normalcy and allow the quality of the assets into which we invest your capital to be recognised by the markets.

FOCUSED ON RECOVERY: SYNCHRONISED EXPANSION

Since November, financial market players have been increasingly confident that vaccine distribution would alter the course of the pandemic—a dramatic but temporary event—and with an end in sight, they positioned themselves for the recovery scenario.

Today, at the close of Q1 2021, investors are anxiously tracking the vaccination process, monitoring its impact on infections, and awaiting confirmation of a long-overdue recovery. The tense wait dominates investor sentiment and is subject to the “Scottish shower” of conflicting news about the speed of vaccination, especially in Europe, where it is slower than anticipated.

After the Christmas holiday, new restrictions across Europe compounded misgivings, as it was confirmed that Q1 2021 would again see weak or negative growth.

Investors should lift their gaze and focus on the ongoing global recovery. Government plans to support the re-launch of the economy have been vigorous, a far cry from the timidity that reigned after the Great Recession of 2008, especially in Europe.

In the US, Biden’s plan surpasses everything previously imagined and constitutes a “super bazooka” that will propel US economic growth by more than 6% in 2021. And thanks to the Next Generation Fund, the European Union will grow in excess of 8%. This synchronised expansion has little precedent in recent decades and harks back to the post-WWII era.

The cyclical momentum of recovery sparks an interest in growth prospects, coupled with misgivings about the risk that a combination of public spending and free flowing liquidity could trigger the reappearance of inflation after decades of virtual nonexistence.

INFLATION EXPECTATIONS AND INTEREST-RATE IMPACT

Many leading observers and economists have surmised that the fiscal and monetary cocktail foreshadows the return of inflation. This is primarily a North American concern given the region’s low level of unemployment and healthy economic support. In Europe, everything is more modest and happens at a slower pace.

No one knows for certain if those fears will materialise. We believe they are justified, though opinion is divided between deflationists and inflationists. It is perfectly compatible that both schools of thought are correct: recall periods of low growth and inflation (stagflation).

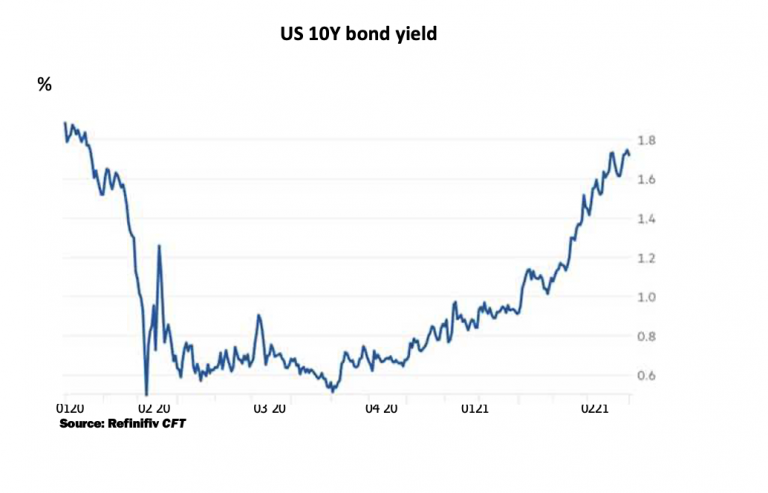

Why is this debate important? For fixed income investors, the prospect of inflation eroding the value of the interest received is worrisome and, to protect themselves, they demand higher yields through lower bond prices. This has occurred in recent weeks, as illustrated by the graph below.

Aftershocks also hit shares. We know the value of a share (and a company) reflects the present value of the expected future profits. That value decreases as the discount rate rises. This causes corrections in companies whose value depends largely on long-term profit growth; tech companies, for example.

PROFITS: A RETURN TO 2019

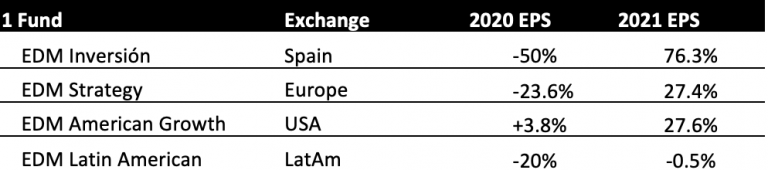

The Q4 2020 results were consistent with the ongoing process of evaluation and adjustment conducted by EDM over the course of the year. In essence, they include a drop in earnings per share (EPS), though no losses. While there is overall optimism about 2021, there is also a fair amount of caution about its quantification.

Our 2021 EPS recovery forecasts for EDM’s equity portfolios are as follows:

Though the growth forecast for 2021 may be surprising, it is worth remembering that it is being compared to a horrible 2020 and that, ultimately, we should be returning to 2019 levels; before all other economies, incidentally, thanks to the exceptional quality of our selection.

OUTLOOK FOR THE YEAR

Because markets are unpredictable in the short term, it is important to invest in the long term. Through this line of reasoning, business evolution becomes the determining factor in the success of an investment. By contrast, in the short term, interest rates have the greatest influence on tactical investing. It is, therefore, perfectly compatible that the EPS of certain companies grow faster than their share prices: in this instance, those shares become cheaper. This may happen in 2021 if the evolution of interest rates that has already begun persists and becomes a mainstay.

Some investors are redirecting their investments toward companies with more cyclical businesses, whose lower long-term growth visibility will be offset by swift momentum once the economy recovers. This rotation is likely to continue throughout 2021.

SELECTING COMPANIES IN AN UNPREDICTABLE ENVIRONMENT

The demand for higher returns among fixed income investors, if accentuated in the future, could paint an unattractive picture for this asset class, with the exception of very short durations and/or inflation-indexed issues. Naturally this affects public debt and investment-grade bonds primarily, high-yield fixed income less so.

A moderately inflationary environment is not necessarily negative for equities, provided cost increases can be passed on to prices, thus protecting corporate margins. But not all companies are in a position to do so and, therefore, selection is once again key to successful investment.

In this respect, diversification continues to define our policy. EDM’s global equities portfolio consists of: (i) high-growth companies (28%); (ii) companies with stable and predictable growth (32%), and (iii) other companies with greater cyclical dependency (40%). All are top quality companies suitable for conservative investors.

It is worth reiterating that EDM’s investment style focuses more on investing in companies of exceptional quality than on trying to anticipate the market. Experience has taught us time and again that this is impossible and 2020 was no exception.

To summarise our mission as a company, we aim to improve the financial future of our clients and the companies in which we invest in the hope that their improved wealth in turn helps enhance the whole of society.

Many thanks for your confidence.

Sincerely,