Investing in financial markets is not dissimilar to our daily lives: in both, we are exposed to a changing environment, replete with uncertainties and moments when we strive to make the best decisions possible given the information available.

It is also evident that, just as fashion repeats, so do the economic cycles of financial markets. The downside is that their length is unknown, so we may believe we are in a bull market when in fact a recessionary process is underway, thus making our investment obsolete.

In recent years, we have endured periods of tremendous instability and uncertainty, in financial markets and our daily lives. One of the phrases we often hear in these situations is, ‘Life is an endurance race.’ The same is true with financial markets: planning and defining a clear, long-term investment philosophy are essential to reaping the benefits.

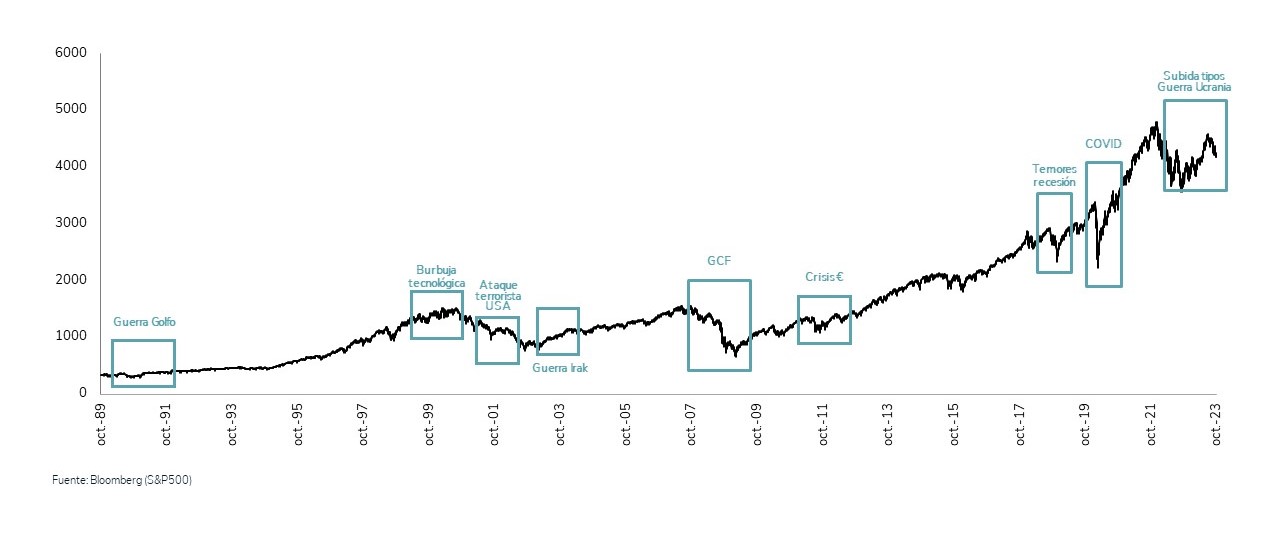

Graph 1. Tracking ‘misfortunes’ from 1989 to 2023.

The previous graph illustrates the evolution of the S&P 500 from 1989 (the year EDM began managing investment funds) to October 2023. Often, with the emergence of a new crisis, distraction and emotion in the short term lead us to believe the world is ending. But when put into perspective, we can see that financial markets recover and ultimately generate value.

To the vast majority of people, the word ‘recession’ means a sharp drop in economic activity, plummeting share prices, and a series of events that trigger a major financial crisis. But that’s not always the case. As an example, in 2023 Germany entered a technical recession (two consecutive quarters with negative GDP growth) and still closed the year with the DAX increasing by roughly 20%.

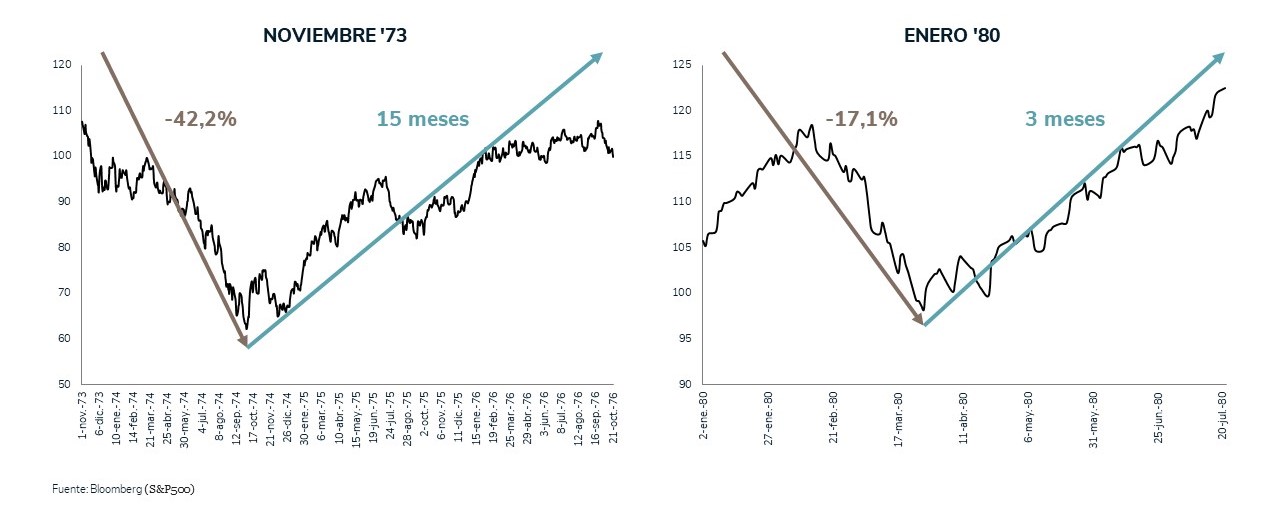

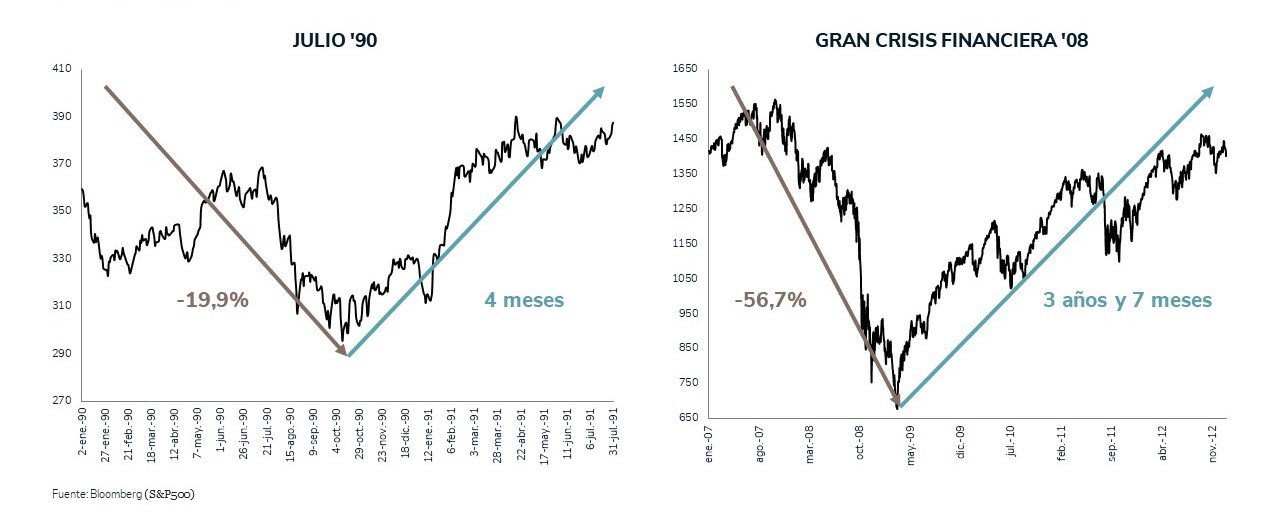

In the following graphs, we track the evolution of the S&P 500 across various recessions.

Graph 2. S&P 500 during the Yom Kippur War.

Graph 3. S&P 500 during the invasion of Iraq and the Great Recession of 2008.

According to the International Monetary Fund, the Great Recession of 2008 was the worst economic and financial collapse since the Great Depression of the 1930s. Therefore, we cannot call it a normal recession, despite being the clearest in recent memory. The other graphs and the table below illustrate how the S&P 500 evolved in other recessions, during the year in which they occurred and the year to follow.

Table 1. S&P 500 returns in recession years.

Two main trends are evident: i) recovery time is not always the same; normally, it is shorter; and ii) the returns. While often returns during the recession year are favourable, 77% of the time they are positive the following year — the Great Recession of 2008 being the exception, not the rule.

A phrase attributed to Warren Buffet perfectly sums up the miscalculation of investing without a clear philosophy and getting swept up by the noise in the short term: ‘The stock market is a device for transferring money from the impatient to the patient.’

We don’t know if we’ll see a recession in 2024, but we do know that the world will not end and we must keep adapting to the market.

Find out, in detail, the good returns of our funds this 2023 in the Letter of the Chairwoman 4T 2023.

Alejandro Cárdenas,

Wealth Manager