Dear client,

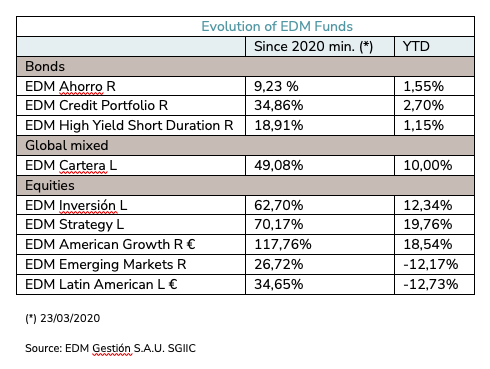

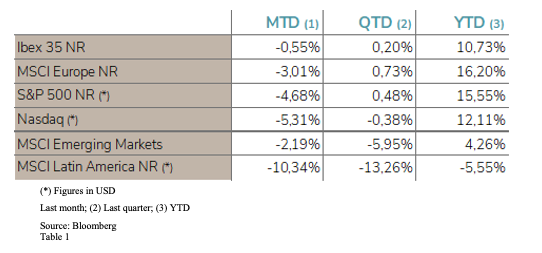

While markets were calm in July and August, September reaffirmed its tradition as a period of high volatility and uncertainty, registering a correction. All in all, the evolution of the main stock indices was positive in the third quarter and has been very positive in YTD terms (Table 1).

The Table illustrates the varying performance of stock markets in the major economic blocs (EU and US) and those in emerging nations (China & LatAm), which lag behind. The Spanish index may trail its European counterpart, but it weathers corrections better thanks to its reliance on companies with cyclical businesses.

Investor anxiety

September’s stock market decline reflects the renewed anxiety of investors. In recent weeks, concerns have re-emerged about a wide range of uncertainties and/or risks, the most relevant being:

- The easing rate of growth in the EU and US due to the impact of the COVID-19 Delta variant;

- Concerns about the future trajectory of inflation;

- The transition to a less expansionary monetary policy;

- Questions about the immediate performance of the Chinese economy and its impact on global growth;

- Supply shortages and the subsequent rise in prices, particularly in energy.

These issues are disrupting financial markets after three extraordinarily favourable years for equity investors, where low interest rates and a lax monetary environment stimulated rising prices across all asset classes.

We honestly do not know what the future holds and, although we are immersed in an accelerated social and economic transition, it is important to recognise that we have endured major changes before.

An ongoing preoccupation with avoiding uncertainty can trigger a detrimental level of anxiety, resulting in inaction. At EDM, we believe it is safer to focus on the quality of investments rather than trying to anticipate the short-term future of markets and the economy with any degree of certainty.

Equity investment drivers

Two drivers underpin the year’s results shown in Table 1:

- Driver no. 1: growth in earnings per share (EPS)

After an unprecedented economic slowdown in 2020, the EPS published in July far exceeded even the best expectations. But we can no longer buy the past and must, therefore, focus on the future. Table 2 illustrates EDM’s ∆ EPS estimates in 2021 and 2022 for our equity funds.

Current interest rate levels “push” many bond investors toward equities: “There Is No Alternative” (TINA).

As the Graph demonstrates, dividend yields—particularly in Europe—far exceed debt profitability, attracting many conservative investors to equities.

Looking ahead: selectivity

It is difficult to pinpoint which of the above risks triggered the September correction given that, after the ample gains of the last three years, any reason serves as a good pretext to exit the market and thus quell anxiety.

Nonetheless, our view confirms that, if the EPS growth we expect occurs, valuations (P/E ratios) in 2022 will be similar to those of 2019, and even lower in the case of Spanish and Latin American shares. It seems difficult to assert that overvaluation is widespread.

At the moment, however, investors must contend with the easing rate of profit growth, which is inevitable in the service (reduced mobility) and industrial (supply shortages, energy prices) sectors. Thus, having reached the peak of y-o-y growth, global economic growth may be slowed—but not derailed—by these factors. In this context, the key to successful investment will once again be selectivity.

No one can say for certain whether current inflation trends will be temporary or persistent. Therefore, it is crucial to invest in companies that—if inflation were to last over time—have the ability to set prices by passing on cost increases and thus protecting their margins.

The extraordinary companies that make up our portfolios have that ability. Generally speaking, those we call “quality companies” provide conservative investors with spectacular long-term appreciations thanks to compound interest and protection against inflation.

The role of bonds

Despite repeated predictions about the end of the prolonged bond supercycle that began in 1983, the fact remains that it persists, though we may see its decline in the coming years.

There are concerns about a protracted period of inflation at current levels, which would put pressure on bond prices. An adjustment, via price declines, requires the utmost caution.

The reality today is that the traditional role of bonds—to generate income and reduce volatility—has yielded part of its appeal to so-called investments in illiquid assets, be they real estate, infrastructure, or private capital. We must remain attentive to this.

In conclusion: the return of volatility

To conclude, markets must adapt to a less linear and more variable environment, defined by i) concerns about growth rates; ii) inflation rates exceeding those of the last 10 years; and iii) increasing political and social polarisation. Is it the end of the world? No, we don’t think so. We have endured similar periods in the past and the best companies will help us successfully weather whatever lies ahead. Still, the peaceful tranquillity of markets in recent months may have momentarily drawn to a close… in other words, a return to normality!

Sincerely,

Appendix