THE ECONOMY: A SUMMER OF CONSUMPTION AND THE COVID-19 DELTA VARIANT

- Mass vaccination in developed countries has allowed a certain degree of normality, which has resulted in increased consumption and more normal behaviour.

- The emergence of the Delta variant makes it difficult to forecast economic growth in the West for the coming months. In fact, it seems inevitable that growth in Q3 2021, and perhaps in Q4 2021, will be lower than expected, especially in the US.

- The two driving forces of the world economy over the last 12 months — the US and China — are, therefore, experiencing some fatigue, but have not compromised their strong growth. In the US, the approval of the Infrastructure Plan lays the foundations for sustained growth in the long term.

- In Europe, the recovery of domestic tourism in countries such as Spain, Italy, Greece, and France (10% – 12% GDP) is the highest growth in a decade, without the Delta variant unduly affecting the economy.

- Fiscal and monetary policymakers are working on the next steps: how much economic support they should gradually phase out and when to do so.

- This dilemma is most relevant in the US, where GDP has already returned to pre-COVID-19 levels. In Europe, this problem is of less concern.

- The adaptation of production to the sudden rebound in demand keeps year-on-year inflation rates at high levels (US +5.8%, Eurozone +3%), although many believe that the rise will be tempered in Q4 2021 or Q1 2022.

THE MARKETS: A WAITING GAME WITH LITTLE DIRECTION

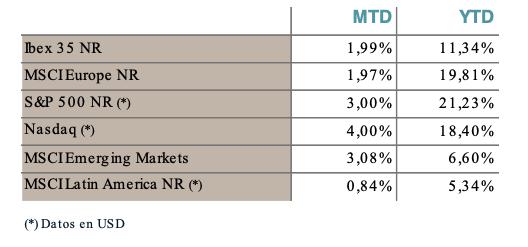

- Western stock markets recorded a monthly increase in August (the ninth of the year), as shown in Table 1.

- Equity investors seem to be more focused on the summer speeches and debates of central bankers at the usual Jackson Hole gathering than in Q3 2021 earnings reports.

- The yo-yo of government debt prices moves these statements around and the euphoria or concerns about how the economy will perform in the coming months.

- The debacle in Chinese technology stocks in August was particularly noteworthy, where companies are facing a very strict regulatory environment. Regulation is undoubtedly the biggest risk for these companies, the market capitalisations of which are stratospheric.

INVESTMENT POLICY: THE POWER OF CENTRAL BANKS

- Central banks are already signalling that once the economies are revived, their concern will be how to proceed with withdrawing so much monetary stimulus.

- Essentially, we are talking about: (1) reducing the volume of monthly bond purchases (QE), and (2) when to start raising interest rates.

- The experience of 2013 (the famous “tapering”) and its negative impact on the stock markets and debt weighs on market anxiety, especially in public fixed income.

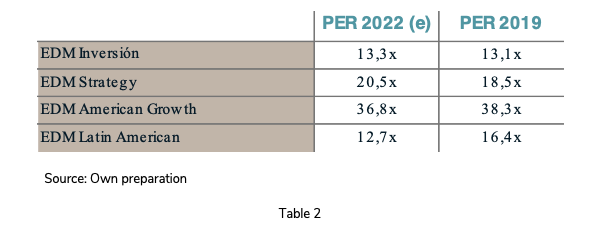

- For the time being, to abandon our view of investing as a long-term exercise, it is good to remember that the expansion of multiples (P/E) is reducing as the year progresses, and we are already focusing on 2022. The multiples for 2022 do not differ much from those of 2019, as shown in Table 2.

- It does not seem likely that the geopolitical situation, caused by the tumultuous withdrawal of the US and its allies from Afghanistan, will have a major impact on the US stock market in the short term, as the majority of the population is against “endless wars”.

- We do believe that it opens a period of revision of the US strategy towards its greatest rival, China.

- For the moment, we are maintaining our slight overweight in equities as long as there is no radical shift in monetary policies and/or a sudden deterioration in EPS (earnings per share) estimates.

LEGAL CONSIDERATIONS

- This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

- EDM Gestión, S.A.U. SGIIC is a Spanish limited liability company registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification number A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

- Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

- The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

- This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

- This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

- To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.