The economy: Debate among macroeconomists

- This summer a debate flared up among macroeconomists, with some predicting a recession in the US, while others believe the Federal Reserve will manage to reduce inflation without job loss (slowdown). Opinions are divided.

- The situation differs in the Eurozone where a slowdown is more palpable given the greater weight of the industrial sector and stronger trade relations with China, itself flirting with deflation.

- In both the US and Europe, those hardest hit by rising interest rates are the industrial and the real estate sectors. Services, meanwhile, propel GDP growth in countries where the sector plays an instrumental role (Spain).

- Emerging economies offer a highly varied panorama, though perhaps most striking is the very real possibility of deflation in China, a backlash against the hasty and prolonged debt process linked, primarily, to the real estate sector.

- Given this scenario, the central banks are finding it difficult to calibrate their monetary policies. They appear to be teetering on the razor’s edge, using language that justifies both a limited and perhaps final hike, and the maintenance of current interest rates.

Markets: The “Scottish” shower of July/August

- Investors dread the summertime because of the unpredictability and volatility linked to the holiday season, during which short-term traders go to the beach, reducing liquidity.

- We saw an example of this in July and August (2023). The macro data for July seemed to confirm that the central banks would sidestep a recession, and stock markets were enthusiastic. Then, in August, statements from certain central banks opened the door to further increases, prompting a correction that was later reversed “in extremis”.

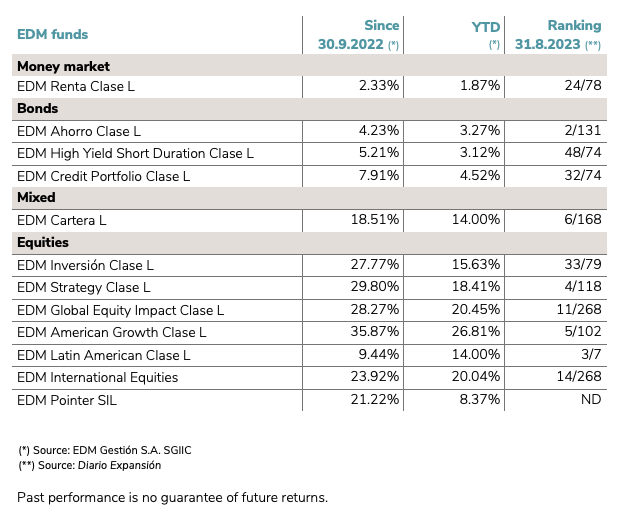

- EDM Funds closed August with positive advances, as illustrated in the table below, which shows the 2023 results, as well as those since September 2022, a moment of peak pessimism.

- Among our selection of quality shares we have seen favourable profit growth in Q3 2023 relative to 2022, as well as risks posed by ongoing interest-rate hikes. Have we seen the last of them?

- Public (sovereign) debt saw maximum volatility consistent with statements from the main central bankers (Jackson Hole). This brought sovereign bond yields to attractive levels for conservative long-term investors (US Treasuries: 4.1%; Bund: 2.46%). Higher yields mean lower prices.

- Finally, the price of high-yield bonds, which rebounded in late August, suggests a degree of over-valuation if a US recession ultimately transpires.

Investment policy: Insisting on diversification

- It is common knowledge that EDM does not apply a tactical, short-term approach to the structuring of portfolios for discretionary management, but a strategic method based on preserving client assets and beating inflation.

- In the next letter from the CEO, scheduled for 30 September, Carlos Llamas will delve into EDM’s investment policy for the coming years, as the period of zero/negative interest rates draws to a close. This conclusion has certain implications.

- Suffice it to say, for the moment, our Asset Allocation Committee has already recommended that we further diversify all portfolio profiles gradually, introducing short-term bonds with more determination now that their returns justify the investment. In future, we expect to increase the number of longer-term equivalents.

- With regard to equities, we remain confident in the obvious: investing in top-quality companies, with reasonable growth prospects and little or no debt.

- These companies can weather both a recession, given low interest rates (P/E ratio), and a slowdown characterised by sluggish but positive growth (EPS). Results for the year (YTD) and since the September 2022 low point prove that it pays to invest in quality.

- Lastly, it is worth noting that the large amounts of money invested in so-called “alternative” investments (real estate, private equity, venture capital) are struggling to match past returns in the new interest-rate environment. In fact, capital is tightening in the latest funding rounds.

LEGAL CONSIDERATIONS

1) This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them to comply with the terms and conditions of the offer in question.

2) EDM Gestión, S.A.U. SGIIC is a limited liability company under Spanish law registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification no.: A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

3) Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

4) The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

5) This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

6) This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

7) To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity, and investment experience and knowledge. To that end, EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.

8) To obtain the mandatory legal information, please visit the website of the management company, EDM Gestión, S.A.U. SGIIC, at www.edm.es. You may also obtain a hard copy of this information upon request, free of charge.