THE ECONOMY: HEALTH RISK ON THE DECLINE

- All data confirm the vaccination rate is accelerating: 40% of the population in the US and 20% in Europe. To this we must add natural immunisation and the youth population.

- Consequently, herd immunity will likely be reached in Q2 2021 in the US and Q3 2021 in Europe, coupled with an expected return to some degree of normalcy.

- Europe is anxiously waiting for the southern countries, heavily dependent on tourism (Spain 14%, Italy 12%, Greece 31%), to enjoy a semi-normal summer season (around 60% of the 2019 high).

- At the same time, Germany, a huge beneficiary of global trade, will see considerable economic recovery in H2 2021 thanks to its exports to China, which are in full flourish.

- In its first 100 days, the Biden administration confirmed its social-democratic reformist approach, as it proposes two additional fiscal packages funded by tax hikes on the highest tax brackets and corporations.

- Dispersed but consistent data indicates a rise in the price of commodities and intermediate products due in large part to a disruption in maritime logistics and an intensive restocking process.

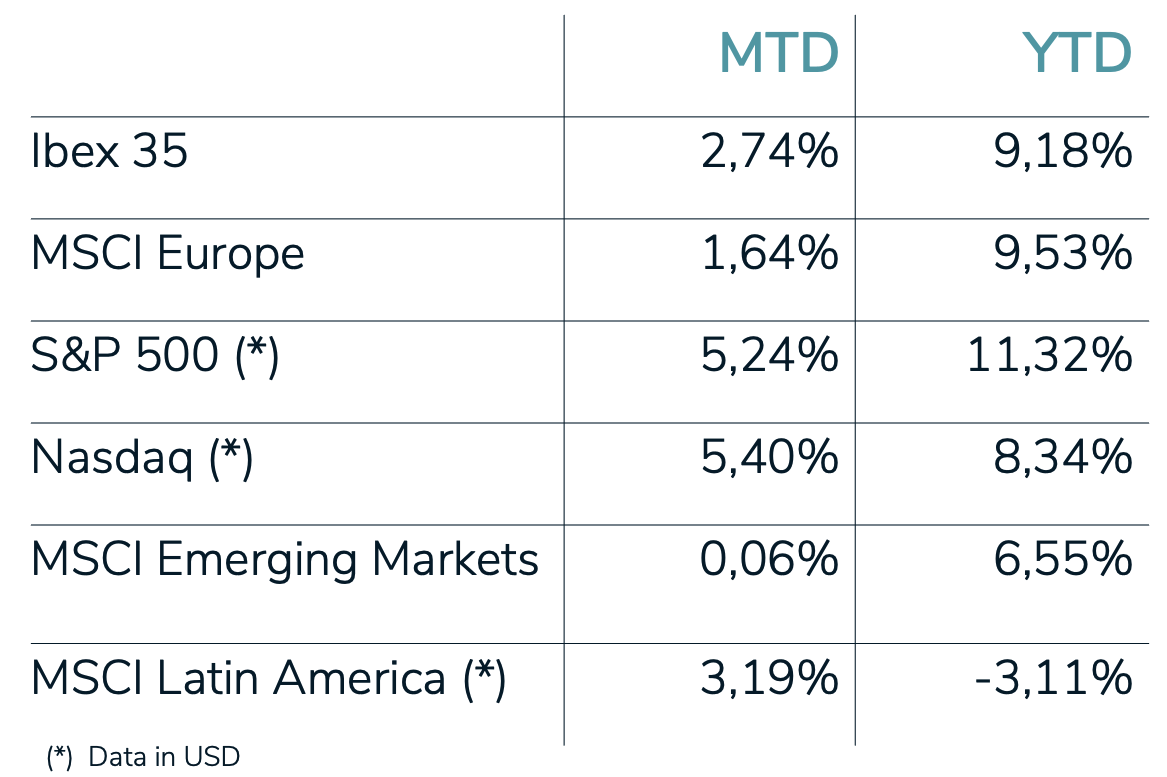

MARKETS: INFLATION EXPECTATIONS

- The markets, preoccupied with the risk of inflation in February and March, seem to have accepted the significant yet temporary increases more calmly.

- The so-called “base effect,” meaning the comparison to 2020 data, revitalises Q2 2021 inflation data in the US, which will be substandard (3.5% inflation y-o-y?).

- The corporate earnings season has started off very well, with many companies reporting growth in excess of pre-pandemic levels.

- This has boosted stock indices, as illustrated below.

- The uptick of share prices has accelerated the pace of IPOs, as well as the sale of companies (M&A), in a concerning sign of possible overheating.

- Sovereign debt markets have risen in price (lower returns) as investors have deferred fears of a structural hike in interest rates.

- The central banks are preparing for a long and difficult period of managing investor expectations. Clearly, misgivings are most evident in the US, given the spectacular boost in public spending and a more advanced economic cycle.

- The US dollar receded marginally this month, and the notion of a slight correction in the medium term prevails on the market.

-

INVESTMENT POLICY: INVEST IN QUALITY

- Though it is difficult to discuss a general stock market bubble, there are certainly overvalued segments, as well as others with very reasonable P/E ratio valuations.

- Therefore, it is worth putting into context the widespread adage that what goes up must come down. Companies with sustained and predictable growth can experience increases in value over long periods of time.

- Identifying these companies, which are few, requires considerable effort and success is not guaranteed. But it is the best investment policy for those who invest in the long term.

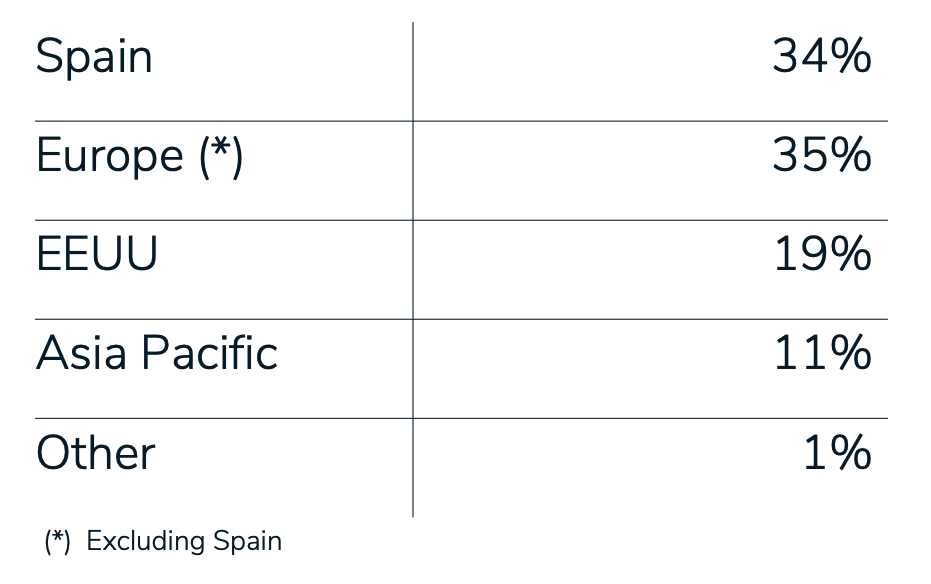

- These companies, which constitute the core of EDM’s portfolios, have geographically diversified businesses.

- For example, sales among the Spanish companies that comprise our EDM Inversión fund are geographically distributed as follows:

- We continue to insist on diversification to enter this long period of economic recovery during which there will likely be volatility.

- Fixed income investors should focus on short term, high-yield corporate debt, though again, confidence in the business model and the quality of the management team is essential.

- Finally, those in search of income should ask if it is not worthwhile to invest in shares of companies that pay dividends much higher than the interest on bonds. Naturally, it is crucial to avoid value traps.