THE ECONOMY: SCOTTISH SHOWER

- All advanced indices (PMI) confirm the widespread recovery of developed countries in both the service and industrial sectors.

- High volatility and uncertainty of macroeconomic data vs. estimates:

- Spike in year-on-year inflation in the US (+5.4%)

- 5th wave of COVID-19 due to the highly contagious Delta variant

- Lower contribution of China to global growth

- Confirmation of a US recovery, despite the Biden Administration’s difficulty in obtaining congressional approval for multi-year plans. Regardless, the pace of the recovery appears to have already peaked.

- European Commission approval of the first plans to receive Next Generation EU funding (Spain, Italy, and Greece).

- Vaccinations progress rapidly in developed nations, though less so in emerging and underdeveloped markets.

MARKETS: TUMULT IN US GOVERNMENT DEBT

- Poor overall inflation data in the US coupled with an ambiguous response from the Fed prompted a surprising drop in US 10Y Treasury yields; many hedge funds incurred losses.

- These developments suggest investors trust that the Federal Reserve will be able to control inflation in the long term, or, alternatively, that they do not expect elevated economic growth.

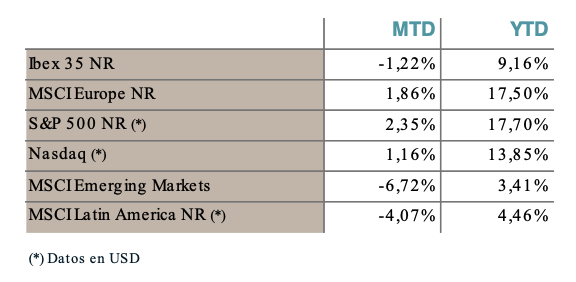

- It was also a very volatile month for markets, with widespread declines and subsequent recoveries among indices. The Spanish Ibex 35 was hit hard by the impact of the banking sector and other cyclical companies that were non-starters in Q2 2021. It was also a substandard month for emerging markets.

- Macroeconomic misgivings have arrived in tandem with simply stellar H1 2021 earnings reports, especially for those companies selected by EDM. Many companies maintained and/or improved their guidelines for the year overall.

-

INVESTMENT POLICY: TRUST IN CORPORATE PROFITS

- Traders and asset allocation managers are hesitant about allocating their assets in H2 2021 given i) widespread unpredictability, ii) the sense that the economic recovery has already passed its peak, and iii) that the gains of the last 12 months have been considerable.

- The tension is palpable and, as a result, investors aim to anticipate the short-term performance of equity and bond markets, which fluctuate like a roller coaster in response to the news or comments from the central banks.

- Our global portfolios are slightly overweighted in equities because we are highly confident about the profit growth forecasts for our selected companies in 2021 and 2022.

- With regard to fixed income, our main funds are clearly in positive territory: EDM Ahorro L (+1.59% YTD) and EDM Credit Portfolio L (+2.39% YTD), contributing to the favourable performance so far this year.

- The shift from growth securities to cyclical securities, which was very effective in Q1 2021, worked in reverse during Q2 2021, when defensive and/or high-growth securities were the indisputable victors.

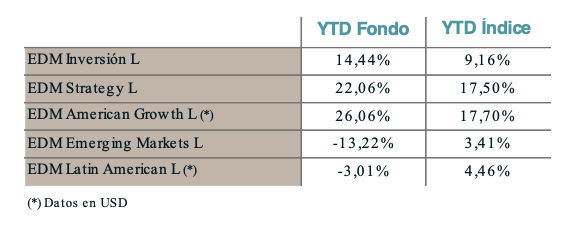

- Our clients benefitted from this and the discretionary portfolios have vastly outperformed the benchmark indices; once again, diversification was key. Funds investing in emerging markets, with less weight in our portfolios, lag behind developed markets.

LEGAL CONSIDERATIONS

- This information, which constitutes EDM advertising, is intended for informational purposes only in accordance with the rules of conduct applicable to investment services in Spain, and is therefore sufficient and understandable for any potential recipient. The information may refer to or entail additional, separate documentation, which you may request from EDM. If this information contains offers of products, financial instruments, or services, recipients may avail themselves to any complementary or additional documentation that enables them the comply with the terms and conditions of the offer in question.

- EDM Gestión, S.A.U. SGIIC is a Spanish limited liability company registered in the CNMV’s Special Registry of Collective Investment Scheme Management Companies (Registro Especial de Sociedades Gestoras de Instituciones de Inversión Colectiva) no. 49, and in the Commercial Registry of Madrid, under volume 36,739, sheet 52, page M-658.326, with tax identification number A-58.217.175. Its activity includes the representation, management, and administration of Funds and Investment Companies located in Spain and subject to Spanish law, in addition to discretionary portfolio management.

- Recipients of this information must take into account the fact that any result or data provided may be subject to fees, commissions, taxes, and expenses, which may decrease or alter the gross result, depending on the nature of each case.

- The instruments included in this information are subject to the potential effects of several common causes, including:

- Market fluctuations due to unforeseen circumstances.

- Liquidity risk and other risks that alter the evolution of the investment.

- This information contains data that reflect the past performance of the cited products. The data is a reference or record used to reach a conclusion, but is in no way an indisputable indicator of future performance.

- This documentation may contain data based on currencies foreign to the recipient. Therefore, the possibility of an upward or downward fluctuation in the value of the currency and its effect on the results of the proposed product or instrument should be taken into account.

- To ensure discretionary portfolio management services are provided within the scope of suitability, MIFID regulations require EDM to collect the necessary information regarding its clients’ investment goals, financial capacity and investment experience and knowledge. EDM will obtain the information needed to create an investment profile of each client, consistent with their particular circumstances. Regulation does not permit EDM to render discretionary portfolio management services without the information necessary to assess the suitability of its clients.